Paying Mortgage Points. What Are They and Is It Worth It?

If you’ve ever looked into financing a home, you’ve probably come across the term “paying points.” This can also be referred to as discount points or buying down the rate. Paying points is a way to pay a fee to the lender today in order to decrease your interest rate on the mortgage. Reducing your interest rate will also reduce the amount of interest you will pay on the loan. This can range from hundreds of dollars to hundreds of thousands saved over the life of the mortgage!

Let’s simplify the idea with an analogy.

Think of interest rates like gas prices. The market is in control. When oil prices go up, gas prices go up. However, each gas station still controls what they charge. Prices can and will change daily, potentially multiple times in the same day. In general, lenders’ pricing is close, but just like gas stations, you will find a few that are much higher than the market or significantly cheaper than the rest. That is where your mortgage broker comes into play! We shop for those lenders to find the best pricing for your specific situation and loan program.

How do you know if paying for mortgage points is right for you?

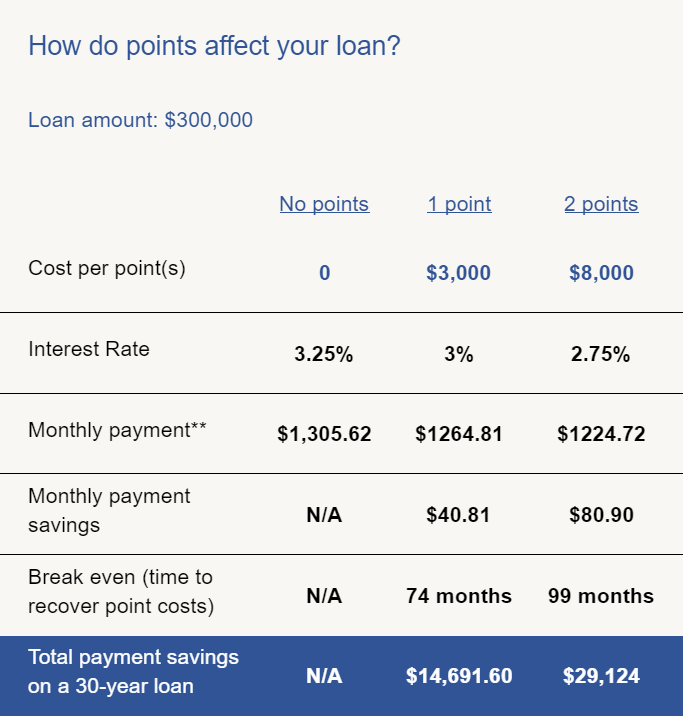

The short answer is doing a net break-even analysis. Your break-even point is the date of when your initial buydown (points paid for that specific interest rate) breaks even with the amount you have saved in interest monthly by taking that lower interest rate. This date is determined by analyzing the cost of the buydown (paying points) divided by the amount that you save monthly in principal and interest. This will give us your net break-even in a number of months. Every month after your break-even, you will be gaining that amount in your pocket above what you paid for the buydown.

Break-even analysis also requires you to know what gas station has the best price. In other words, you have to know what lenders are available and who is offering the best deals on any given day.

So, you have two options. One, call lenders, aggregate their price sheets and use this formula to determine your break-even point: total cost of points/monthly savings = months until break-even. The formula is easy. Determining the total cost of points and monthly savings is tough.

Or two let Chissell Mortgage calculate the break-even date for you.

Want us to run your break-even analysis? Call us at (727) 376-6900 or visit https://www.chissellmg.com/Contact.

NMLS ID: 327290; NMLS ID: 2062741

Equal Housing Opportunity

Start Your Home Loan with Chissell Mortgage Group.

Your local mortgage broker.

NMLS #2062741